Changes to Fuel Tax Credits calculations

Simplified Fuel Tax Credits calculation methods

The ATO have introduced new simplified methods for calculation of fuel tax credits for businesses that claim less than $10,000 each year. From the BAS period ending 31 March 2016 and onwards, you are able to use either or both of the following simplified methods.

Use one rate in a BAS period

Under the new simplified fuel tax credit rules, you are able to calculate your fuel tax credit claim using the rate that applies at the end of the period. When the rate during the BAS period changes (i.e. in February and August) you no longer have to split your fuel purchases and use two different rates.

We recommend the ATO’s useful fuel tax credit calculator which can be accessed here to calculate your fuel tax credit entitlements. When using the fuel tax credit calculator, enter ‘0’ in the first rate period and your total fuel purchases in the final rate period.

Work out your litres

The simplified fuel tax credit rules also allow you to calculate the quantity of fuel purchased by dividing the total cost of fuel purchased by the average price per litre for the BAS period.

You calculate your litres as follows:

Litres = Total cost of fuel purchased

Average price of Fuel

You can find the average price of fuel from the Australian Institute of Petroleum website here.

Heavy Vehicles used mainly off public roads

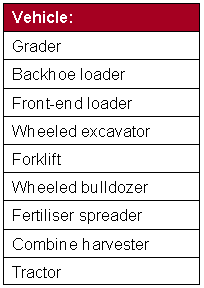

The ATO have created a list of heavy vehicles that are mainly used off public roads and are not for the purpose of carrying goods and passengers. Whilst these vehicle may have some incidental travel on public roads, the ATO have advised that you do not have to apportion on and off-road travel when calculating your full tax credits for your March 2016 BAS onwards. For these vehicles, all fuel used can be claimed at the “all other business uses” rate, even if they are occasionally driven on public roads.

DISCLAIMER: The contents of this publication are general in nature and we accept no responsibility for persons acting on information contained herein. The content of this newsletter does not constitute specific advice and readers are encouraged to consult their Ruddicks adviser on any matters of interest. © Ruddicks 2016