Christmas Parties and Gifts

Taxation treatment of gifts is different depending on whether they are classed as entertainment or non entertainment.

Gifts (not entertainment)

The costs associated with providing Christmas gifts (e.g. hampers, a bottle of whiskey, wine, gift cards, perfume, etc) to clients will not give rise to any FBT liability but they will still be tax deductible to the business and GST input tax credits can be claimed, where appropriate.

Gifts provided to employees and their families will have FBT implications but they will also be tax deductible to the business and GST input tax credits can be claimed. However, as a general position where the gift has a value of less than $300 per person (e.g. $250 for employee and $250 for spouse) and it is a one off gift, it will be exempt from FBT as a minor benefit but will continue to be tax deductible with input tax credits available. Certain other gifts may be exempt from FBT where they fall within specific limited exemptions within the FBT legislation (e.g. airport lounge memberships and tools of trade) regardless of cost.

Gifts (entertainment)

Gifts which are considered entertainment generally include:

- Restaurant meals;

- Tickets to attend a theatre, live play, sporting event, movie, etc;

- Holiday airline ticket;

- Amusement centre pass.

Such gifts to employees and their families will have FBT implications but they will also be tax deductible to the business and GST input tax credits can be claimed. Where the value of the gift is less than $300 per person and it is a one-off gift, it will be exempt from FBT as a minor benefit. In this instance the expenditure becomes non tax deductible.

Entertainment gifts provided to clients will not give rise to any FBT liability and will not be tax deductible to the business. No GST input tax credits can be claimed in respect of such gifts made to clients.

Functions

The correct tax treatment of costs associated with Christmas functions can be confusing. Broadly, entertainment expenses such as Christmas party costs are only tax deductible, and GST input tax credits only available, to the extent that FBT is paid on the costs.

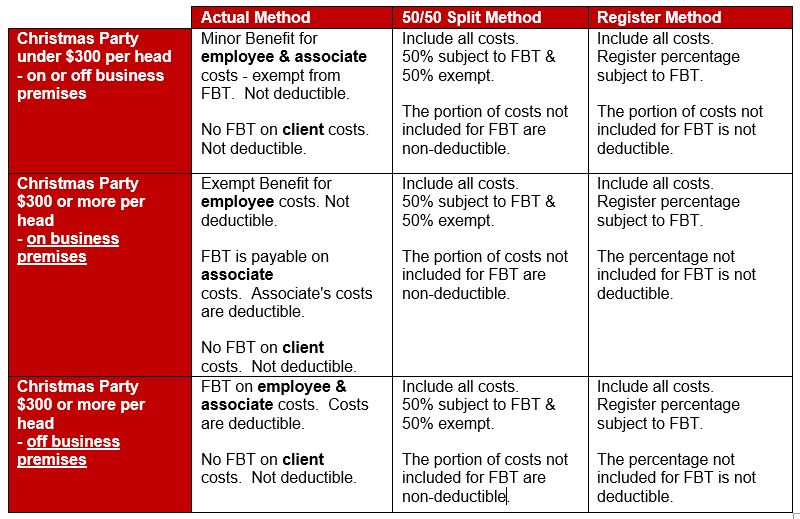

The following is a summary of the treatment of function costs, which will depend on the method used to value entertainment for FBT purposes. The Actual Method detailed in the first column is the one most commonly used by taxpayers.

Please contact your Ruddicks adviser if you have any questions or require any further information.

DISCLAIMER:

Liability limited by a scheme approved under Professional Standards Legislation.

The content of this newsletter is general in nature. It does not constitute specific advice and readers are encouraged to consult their Ruddicks adviser on any matters of interest. Ruddicks accepts no liability for errors or omissions, or for any loss or damage suffered as a result of any person acting without such advice. This information is current as at 3 December 2018, and was published around that time. Ruddicks particularly accepts no obligation or responsibility for updating this publication for events, including changes to the law, the Australian Taxation Office’s interpretation of the law, or Government announcements arising after that time.

Any advice provided is not ‘financial product advice’ as defined by the Corporations Act. Ruddicks is not licensed to provide financial product advice and taxation is only one of the matters that you need to consider when making a decision on a financial product. You should consider seeking advice from an Australian Financial Services licensee before making any decisions in relation to a financial product. © Ruddicks 2018