Superannuation Guarantee Amnesty - action required by 7th September 2020

IMPORTANT! SG amounts arising after the 31st March 2018 are not eligible for the Amnesty and for these you are still required to meet the standard payment due dates. If you are unable to do so for the March 2020 quarter, the ATO advice is that you should lodge an SGC statement with the ATO by 28 May 2020 to avoid additional nominal interest and penalties. The ATO is currently providing lenient payment plan terms and flexibility and which are definitely beneficial, however these late payments will remain non-deductible. This, unfortunately, is a feature of the law and not something that can be administratively changed by the ATO.

What is the Amnesty and why was it needed?

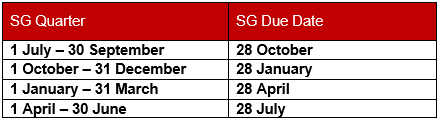

By way of a background, employers are required to make superannuation contributions for their employees at a minimum rate of 9.5% of the employees’ Ordinary Time Earnings to the employees’ chosen superannuation funds. These superannuation contributions, referred to as superannuation guarantee (SG) contributions, are required to be paid no later than the legislated quarterly due dates:

If these mandated super contributions are made within the required timeframes, then the payments are tax deductible to the employer when they are made and no further government surcharges apply to these.

If SG is not paid on time

If, however, the required payments are not made by the above due dates each quarter, then certain penalties apply automatically:

- The shortfall amount is calculated based on the affected employees’ total salary and wages – generally, a broader base than Ordinary Time Earnings, so that the shortfall is potentially higher than the original SG amounts AND

- Interest on the shortfall amount is calculated at 10% per annum AND

- An administration fee of $20 per affected employee per each quarter in which a shortfall arose

The sum of the above is referred to as Superannuation Guarantee Charge or SGC. In addition to SGC, employers may be liable for additional penalties of up to 200% of the SGC amount, imposed at the discretion of the ATO.

Finally, none of the above payments including the SG shortfall, are tax deductible.

The longer an employer is overdue on SG payments, the higher the liability (all non-deductible) and potential penalties. As a result, many employers with outstanding superannuation obligations are reluctant to voluntarily disclose the outstanding amounts to the ATO.

The Amnesty was introduced as a limited-time offer of concessions to employers to enable them to catch up with outstanding superannuation amounts and clean up any underpaid amounts which may have arisen for a number of reasons, including:

- Not classifying correctly allowances (e.g. car allowances), leave loading and bonus payments;

- Misinterpretation of the requirements under an enterprise bargaining agreement or industrial award;

- Incorrectly classifying employees as contractors and/or not recognising that payments to some contractors are also subject to SG.

Amnesty Terms

Employers who voluntarily disclose their non-compliance to the ATO during the Amnesty period will be entitled to the following concessions:

- Income tax deductions for SGC amounts disclosed;

- Waiver of the $20 administration fee; and

- Waiver of any penalties.

As the amnesty was first announced on 24 May 2018, the concessions will only apply to shortfall amounts incurred for quarters between 1 July 1992 and 31 March 2018.

Any shortfall arising from subsequent periods will be subject to SGC in full, including the $20 administration fee per employee, and will remain non-deductible for income tax purposes.

During the Amnesty period, the ATO will continue to conduct SG reviews and audits, and any non-compliance detected through these activities will not be eligible for the Amnesty concessions and may be subject to penalties at the Commissioner’s discretion.

What about SG arising after 31 March 2018?

These SG obligations are not eligible for the Amnesty.

The impact of COVID-19

The ATO has issued the following statement, offering additional flexibility for employers taking advantage of the Amnesty:

“We understand you may wish to apply for the superannuation guarantee amnesty (the amnesty) and may be concerned that, as a result of COVID-19, your circumstances may change and you will not be able to pay the liability.

If you want to participate in the amnesty, the law requires you to apply by 7 September 2020.

However, we will work with you to establish a payment plan that is flexible to help you to continue making payments. These arrangements include:

- flexible payment terms and amounts which we will adjust if your circumstances change

- the ability to extend the payment plan to beyond 7 September 2020, the end of the amnesty period. However, only payments made by 7 September 2020 will be deductible.”

Please contact your Ruddicks adviser if you wish to take advantage of these flexible arrangements.

Applying for the Amnesty

In order to take advantage of the Amnesty, employers will need to apply for it no later than 7 September 2020, using the ATO-approved SG Amnesty form.

We strongly recommend that you consider taking advantage of this window of opportunity. Please contact us to discuss your situation before applying for the Amnesty to ensure that the information submitted to the ATO is correct, as the forms and calculations are not straightforward.

Additional SG Amnesty information

The ATO has additional information available here.

DISCLAIMER:

Liability limited by a scheme approved under Professional Standards Legislation.

The content of this newsletter is general in nature. It does not constitute specific advice and readers are encouraged to consult their Ruddicks adviser on any matters of interest. Ruddicks accepts no liability for errors or omissions, or for any loss or damage suffered as a result of any person acting without such advice. This information is current as at 7 May 2020, and was published around that time. Ruddicks particularly accepts no obligation or responsibility for updating this publication for events, including changes to the law, the Australian Taxation Office’s interpretation of the law, or Government announcements arising after that time.

Any advice provided is not ‘financial product advice’ as defined by the Corporations Act. Ruddicks is not licensed to provide financial product advice and taxation is only one of the matters that you need to consider when making a decision on a financial product. You should consider seeking advice from an Australian Financial Services licensee before making any decisions in relation to a financial product. © Ruddicks 2020