Depreciation concessions

1. Instant asset write-off (IAWO)

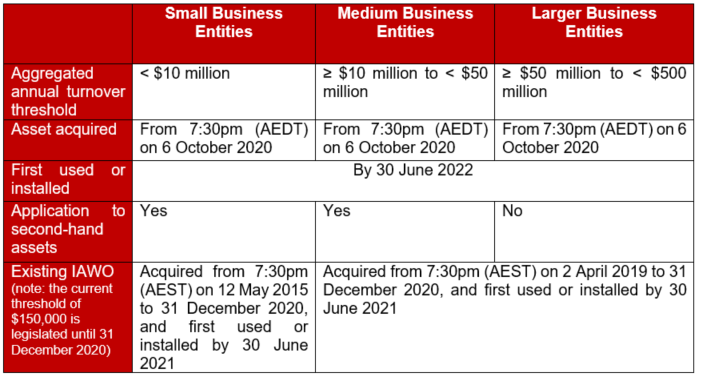

Businesses with turnovers of up to $500m will benefit from the instant asset write-off, with the threshold having been raised to $150,000 until 30 June 2020. IMPORTANT: on 9 June 2020, the Treasurer announced an additional 6 months extension of the $150,000 threshold to 31 December 2020.

Background

- Pre-pandemic, the threshold was set at $30,000 up to 30 June 2020 with the write-off only applying to businesses with turnovers of up to $50m.

- The March 2020 measure increased the cost threshold to less than $150,000 per asset as well as extending this concession to businesses with annual turnovers between $50m and $500m for the first time. The March 2020 changes were temporary, designed to run only until 30 June 2020. From 1 July 2020, the rules were to revert to the $1,000 threshold and to access for small businesses only (turnover less than $10 million.

- The Treasurer's announcement on 9 June 2020 has flagged that additional legislation will be introduced to further extend the March 2020 measures until 31 December 2021.

Where does that leave us now?

As of 9 June 2020, businesses with turnovers of up to $500m can access IAWO for the following:

- Assets costing less than $150,000 bought and installed ready for use by 30 June 2020 (legislated)

- Assets costing less than $150,000 bought and installed ready for use between 1 July 2020 and 31 December 2020 (announced but not yet legislated).

From 1 January 2021, only businesses with turnovers of up to $10m will be able to write off assets costing less than $1,000. Businesses with turnovers of $10m or higher will not be able to use IAWO.

Both new and second-hand assets are eligible for IAWO provided they are under the relevant cost threshold.

Car cost limit – Any depreciation claims for cars are limited to the car cost limit, which we discuss in detail below.

We also include a quick recap of the instant asset write-off rules below under the heading Instant asset write-off do’s and don’ts.

2. Accelerated depreciation on new assets

In addition to the instant asset write-off, there is an accelerated depreciation concession that runs from 12 March 2020 to 30 June 2021.

This is available to businesses with a turnover of less than $500m and will enable them to claim 50% of the cost of eligible assets on installation, with the existing depreciation rules applying to the other 50% of the cost.

It is important that the eligible assets are located in Australia, and are acquired and used, or installed ready for use, before the end of the 2021 financial year. If the asset is not located in Australia, or is not delivered, installed and ready for use by 30 June 2021 it will not be eligible for the accelerated depreciation.

Second-hand assets are not eligible for the accelerated depreciation, only new assets.

Eligible assets are new depreciable assets such as machinery, tools, plant and equipment and vehicles, but not buildings. If you are unsure about whether an asset would qualify, please contact us to discuss.

Car cost limit – Any depreciation claims for cars are limited to the car cost limit, which we discuss in detail below.

OUR COMMENT – DEPRECIATION MEASURES

Businesses with aggregated turnover under $500m will be able to use the following depreciation concessions, subject to the instant asset write-off rules and the car cost limit discussed below:

IMPORTANT! If the balance of a Small Business Entity’s (aggregated turnover below $10m) general small business pool is less than $150,000 at 30 June 2020, the small business entity can claim a deduction for the entire balance of the pool in the 2020 year. This means that Small Business Entities with pool balances under $150,000 will benefit from this measure even if they don’t purchase any new assets.

How could this potentially assist cash flow?

Entities should consider whether they (or related entities within the group) have paid PAYG instalments during the 30 June 2020 income year and whether the new measure could assist in reducing the overall tax payable for the entity (or related entities within the group) for the current income year. In such a case, taxpayers could re-estimate their tax payable and seek to reduce their future PAYG instalments or (alternatively) lodge their 30 June 2020 tax returns shortly after year-end to receive a refund of overpaid instalments.

Instant asset write-off do’s and don’ts

- Only individuals and entities that run a business and whose aggregated (i.e. group) turnover is within the relevant turnover threshold are eligible to use the instant asset write-off (IAWO). A taxpayer that is a passive investor, e.g. investing in real estate or shares, will generally not be eligible for the IAWO, unless their activities amount to running a business. The decision as to whether your or your entity’s activities amount to running a business is not a straightforward one and we recommend that you consult your Ruddicks adviser if you are unsure.

- IAWO applies to depreciable assets such as vehicles (subject to the motor vehicle cost limit! – see below), machinery, plant & equipment, furniture, computers and electronic devices amongst other things, but not to land, buildings (construction or improvements of existing ones), horticultural plants or in-house software.

- IAWO does not apply to assets that are leased out, or are expected to be leased out, for more than 50% of the time on a long to medium term basis. This includes leases to related parties, even if said related party uses the asset in its business.

- Only assets that are used for income-producing purposes can be written off. If an asset is only partially used for income-producing purposes then only the relevant portion of that asset will be eligible for the IAWO. Businesses buying assets that will be used for entirely private purposes will not be able to write those assets off for tax purposes.

- It is important that the eligible assets are acquired and used, or installed ready for use, before the end of the financial year. Merely ordering and paying for an asset before the year end will not qualify a business for a tax deduction in the 2020 year if the asset is not delivered, installed and ready for use by 30 June 2020.

- The cost threshold applies on a GST-exclusive basis for businesses registered for GST, i.e. under the extended IAWO GST-registered businesses will be able to spend up to $150,000 plus GST on assets eligible for the immediate tax deduction, subject to satisfying the other rules discussed here.

- Businesses that are not registered for GST must apply the IAWO cost threshold on a GST-inclusive basis, i.e. they are only able to spend up to $150,000 including GST, i.e. just over $136,000 before GST.

- IAWO applies to new and second-hand assets.

- The threshold applies on a per asset basis, so eligible businesses can immediately write-off multiple assets.

Motor vehicles and the car cost limit

- In addition to the above restrictions, the amount deductible under depreciation provisions in respect of cars (including station wagons and four-wheel drives) is limited to the car cost limit which is $57,581 (GST exclusive) for the 2020 financial year. For the 2021 financial year, the car cost limit is $59,136 (GST exclusive).

- This is the case regardless of whether you are claiming depreciation under the standard provisions, small business entity general pool rules or the IAWO. The car cost limit will apply to override the overall IAWO threshold of $150,000.

- For practical purposes, the IAWO and the accelerated depreciation concession for cars is limited to $57,581 in the 2020 financial year and to $59,136 in the 2021 financial year.

- The cost limit applies on the price of the car before the value of any trade-in is applied.

- The cost limit applies to new and second-hand cars (but note that the accelerated depreciation measure will not apply to second-hand cars in any event).

- “Car” is defined to mean a motor vehicle (other than a motorcycle) designed to carry a load of less than one tonne and fewer than nine passengers. Furthermore, the car limit only applies to cars designed mainly for carrying passengers. This means that certain commercial vehicles will not be subject to the cost limit.

DISCLAIMER:

Liability limited by a scheme approved under Professional Standards Legislation.

The content of this newsletter is general in nature. It does not constitute specific advice and readers are encouraged to consult their Ruddicks adviser on any matters of interest. Ruddicks accepts no liability for errors or omissions, or for any loss or damage suffered as a result of any person acting without such advice. This information is current as at 9 June 2020, and was published around that time. Ruddicks particularly accepts no obligation or responsibility for updating this publication for events, including changes to the law, the Australian Taxation Office’s interpretation of the law, or Government announcements arising after that time.

Any advice provided is not ‘financial product advice’ as defined by the Corporations Act. Ruddicks is not licensed to provide financial product advice and taxation is only one of the matters that you need to consider when making a decision on a financial product. You should consider seeking advice from an Australian Financial Services licensee before making any decisions in relation to a financial product. © Ruddicks 2020